By Christina Kass

In many cases, having a lien on your property should be avoided at all costs. However, if you have a mortgage, then you definitely have a lien on your home — and that’s not necessarily a bad thing. There are, in fact, several types of property liens, and residential homes are often subject to more than one lien. Knowing the difference between them can help you to better understand your rights.

You may be wondering: “What, exactly, is a lien?” Simply put, a lien is a legal right or claim against a property by a creditor. Banks and credit unions commonly place liens against properties so they can collect what is owed to them.

A Closer Look at Property Liens and Their Purpose

A lien is essentially a notice attached to your property announcing that a creditor claims you owe it a sum of money and it’s filed in the public record in your county of residence. When a creditor puts a lien on your property, that property becomes collateral for the debt.

Since the promissory note you sign as part of your mortgage closing says you agree to pay back the amount you borrow, the mortgage that your sign creates the lien against your property in the amount that you owe. When you’re ready to sell or refinance your property, your current mortgage will need to be paid off to have clear title.

Unpaid liens can slow down or even halt a transaction because they essentially “cloud” the property title. In addition to unpaid mortgages, other liens can be filed against a property due to unpaid debt. Other types of liens can include unpaid taxes or assessments, or for payments owed to contractors for work done on the home.

Creditors can seize, repossess or foreclose on the property as a form of payment on the debt. They can also claim first rights to profits from the property when it is sold or refinanced. Liens are usually attached to and transferred with the property, not the property owner. That means if homeowners buy a property with a lien against it, they become responsible for the debt.

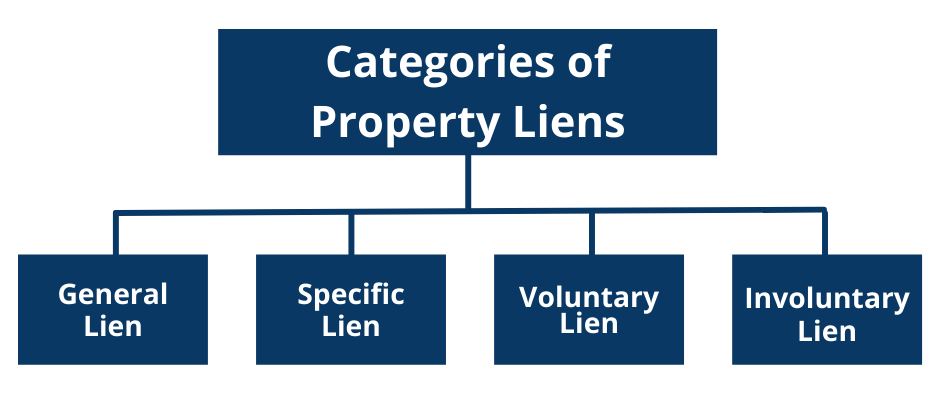

Understanding the Basic Categories of Property Liens

All liens fall under a combination of two basic classifications. These are general or specific liens and voluntary or involuntary liens (also referred to as consensual and non-consensual liens). Here’s a breakdown of these classifications:

- General Lien – A claim against some or all of a debtor’s property; any property may be sold to satisfy the debt.

- Specific Lien – A claim against a specific piece of property; only that individual property may be used to collect against the debt.

- Voluntary Lien – A lien in which a borrower puts up their property as collateral for a loan.

- Involuntary Lien – One used when the property owner did not give their express consent.

A mortgage is the best example of a specific and voluntary lien, since a homeowner freely enters into it to finance his or her property. This type of lien does not negatively affect the property, its title or the homeowner’s ability to convey or transfer the title.

On the other hand, involuntary liens are detrimental as they can make refinancing or selling your home difficult. These are imposed by law and placed on a property due to unpaid obligations. An IRS tax lien is an example of a general and involuntary lien.

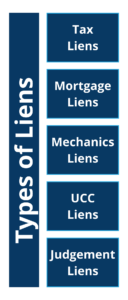

Getting To Know the Common Types of Property Liens

Each of the specific types of liens has different purposes and conditions. So, what are the main types of liens placed on the property?

- Tax Liens – Tax liens are created by state or federal statute and typically don’t result in foreclosure, except for property taxes which can result in forfeiture. If an individual or company fails to pay their taxes, the IRS or other government entity can place a lien on the property for the amount of unpaid taxes (including income, business). These liens usually take priority over all other mortgages and liens.

- Mortgage Liens – As mentioned above, a mortgage lien is used when a bank lends money to purchase or refinance a home. The borrower promises collateral (the property) to secure the loan in case they stop making payments. The lender can foreclose on the property and then take possession of the home.

- Mechanics Liens – Pertinent to the construction industry, mechanics liens are involuntary, specific liens created through statutory rights. Laws in each state give construction businesses and laborers the right to claim such liens. They occur when a contractor, supplier, equipment lessor or other licensed professional provides construction or repair services. If those parties are unpaid, the licensed individual or company can file a lien against the associated property.

- UCC Liens – A UCC -1 Fixture Filing is a legal notice filed by creditors as a way to announce their rights to collateral on secured loans. These fixture filings are usually filed with the State but can also be filed at the County level if the collateral is tangible property such as equipment. There are two types of UCC-1 filings. One is a UCC lien that is against specific collateral and is most often used for inventory or equipment financing. The other is a blanket lien with gives the creditor a security interest in all of the borrower’s assets. It is most commonly used when the loan is given by a bank as well as loans guaranteed by the Small Business Administration (SBA).

- Judgment Liens – The direct result of a lawsuit, this type of involuntary lien can be placed on your property after a creditor sues you and wins the case. Judgment liens are most commonly used by unsecured creditors, such as the holders of credit card debt, personal loans, and medical bills. They can also be imposed by an attorney if you do not pay your bill for their services. These are general liens that affect all real estate property owned.

Let Vanguard Protect Your Real Estate Transaction

At Vanguard Title, we understand that no one wants to take on a property that has unknown liens filed against it. That’s why we conduct an in-depth and exhaustive title search as part of your closing to uncover liens, judgements, easements, and much more.

We work behind the scenes to help remove any existing “clouds” prior to issuing your title insurance policy. You can rest easy, knowing we’ve decreased your financial risk. Plus, we’ll alert you when a cloud is difficult to clear, so you’ll be armed with the information you need in order to decide whether completing the transaction makes sense.

Be sure to watch future blogs to learn how to remove a lien from a property.